Indicators on Medicare Supplement Plans - Univera Healthcare You Should Know

Not known Facts About Supplemental insurance for Original Medicare (Medigap plans)

Policy Numbers: Strategy A: UWMSP(A)-2010, Plan F: UWMSP(F)-2019, Plan High Deductible F: UWMSP(F-HD)-2019, Strategy G: UWMSP(G)-2019, Plan High Deductible G: UWMSP(G-HD)-2020, Plan N: UWMSP(N)-2019, Medicare Select Strategy F: UWMSP-SEL(F)-2021, Medicare Select Strategy G: UWMSP-SEL(G)-2021, Medicare Select Plan N: UWMSP-SEL(N)-2021. Benefits and premiums under this policy might be suspended for approximately 24 months if you become entitled to benefits under Medicaid.

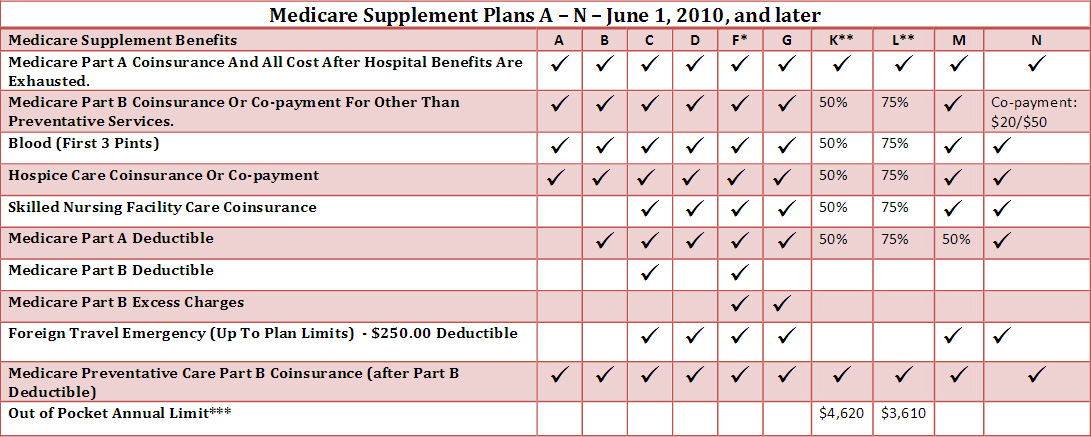

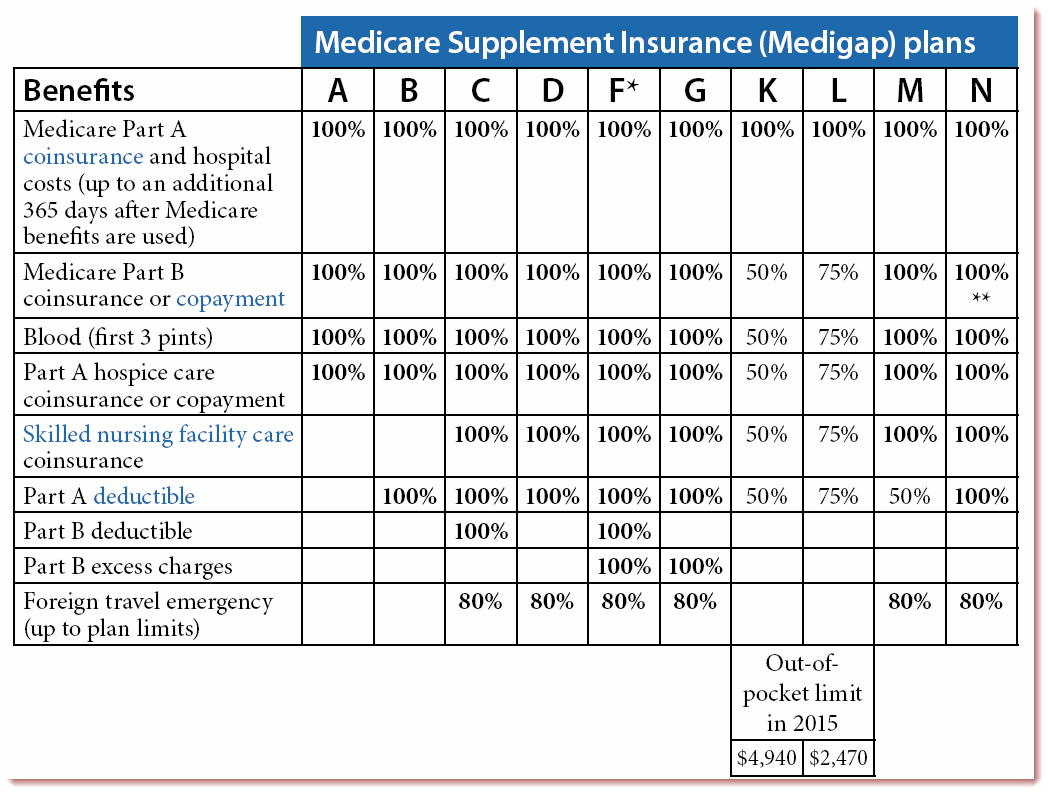

Comparison Chart of All 10 Medicare Supplement Plans & Policies

If you lose (are no longer entitled to) take advantage of Medicaid, this policy can be restored if you request reinstatement within 90 days of the loss of such advantages and pay the necessary premium. There is a 30-day totally free assessment period to have the premium paid refunded. Not all of these plans are provided by Blue Cross and Blue Guard of Texas.

Medicare Supplement Plan Comparison - Trusted Senior Specialists

Strategies cover medically essential emergency situation care services required right away due to the fact that of an injury or disease of sudden and unexpected beginning, starting throughout the first 60 days of each trip outside the U.S. There is a deductible of $250 and a lifetime optimum benefit of $50,000. The out-of-pocket annual limit might increase each year for inflation (2022 limits revealed).

Regence Medicare Supplement (Medigap) Things To Know Before You Buy

These high deductible plans pay the exact same benefits as Strategies F and G after one has paid a calendar-year $2,490 deductible. Take Key Reference Of High Deductible Strategies F and G will not begin up until out-of-pocket expenditures are $2,490. Out-of-pocket expenses for this deductible are expenditures that would ordinarily be paid by the policy.

COVID-19 Updates Avera, NOW: If you have a basic health problem, log in to Avera, NOW so you do not have to visit a center. To motivate use of virtual check outs, Avera Health Plans is waiving co-pays for all member prepares through June 30 when you pick the Urgent Care visit. This will assist slow the spread of COVID-19.

Go to Avera's resource page for more information about our reaction to COVID-19. Welcome to Avera Health Plans! If you have a Medicare Supplement Insurance plan through Avera Health Plans, you're in the best location. Your Medicare Supplement plan will help you close the gap in your coverage for the costs that Medicare approves, but does not pay in full.